Homeowners in Florida have been facing a significant financial burden as the cost of homeowners insurance continues to skyrocket. This surge in insurance premiums is primarily driven by various factors including severe weather events, inflation, insurance fraud, excessive litigation, and changes in reinsurance rates. What are the reasons behind the rising costs of homeowners insurance in Florida? What impact will this have on residents? We’ve researched and chatted with experts to answer these questions as well as provide solutions that can help mitigate financial strain.

The Impact of Severe Weather and Inflation

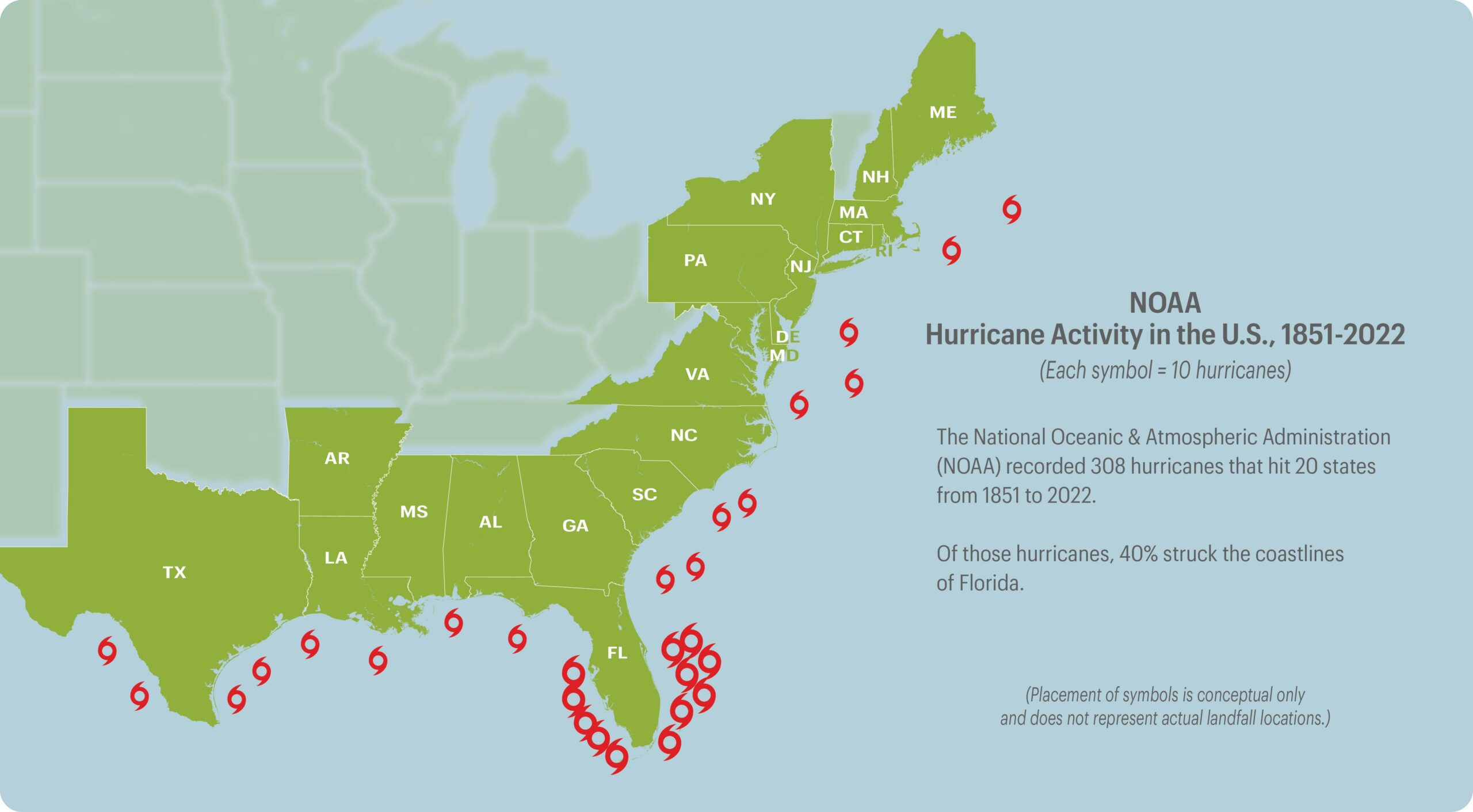

Florida is no stranger to severe weather, with hurricanes and other natural disasters posing a significant risk to homeowners. According to the National Oceanic and Atmospheric Administration (NOAA), there have been 308 hurricanes that have hit 20 U.S. states from 1851 to 2022. Over 40% of these hurricanes were in Florida1. Florida’s hurricane count is more than double that of Texas, the second-most hurricane-affected state.

And things are not slowing down. In May 2023, NOAA predicted a 30% chance of Florida having an above-normal hurricane season. Three months later, NOAA updated their predictions to a 60% likelihood that Florida will experience an above-normal season.

The high frequency of these events has led to increased construction costs as well as higher expenses associated with rebuilding and replacing damaged homes. The Insurance Information Institute has projected that property insurance rates in Florida could surge by up to 40% in 2023 due to inflation and the continuing impact of severe weather events. Florida’s insurance rates are nearly four times the national average. Residents of the state pay approximately $6,000 per year to insurers for home ownership coverage, a stark contrast to the national mean of $1,700.

The Role of Insurance Fraud and Excessive Litigation

Insurance fraud and excessive litigation have also contributed to the escalating costs of homeowners insurance in Florida. The state leads the nation in homeowners insurance-related litigation, accounting for 79% of lawsuits across the country while representing only 9% of total claims. Fraudulent roof-replacement schemes and generous attorney fee mechanisms have resulted in substantial net underwriting losses for insurers. A 2017 state Supreme Court decision that allows higher hourly billing rates for attorneys has further exacerbated the situation.

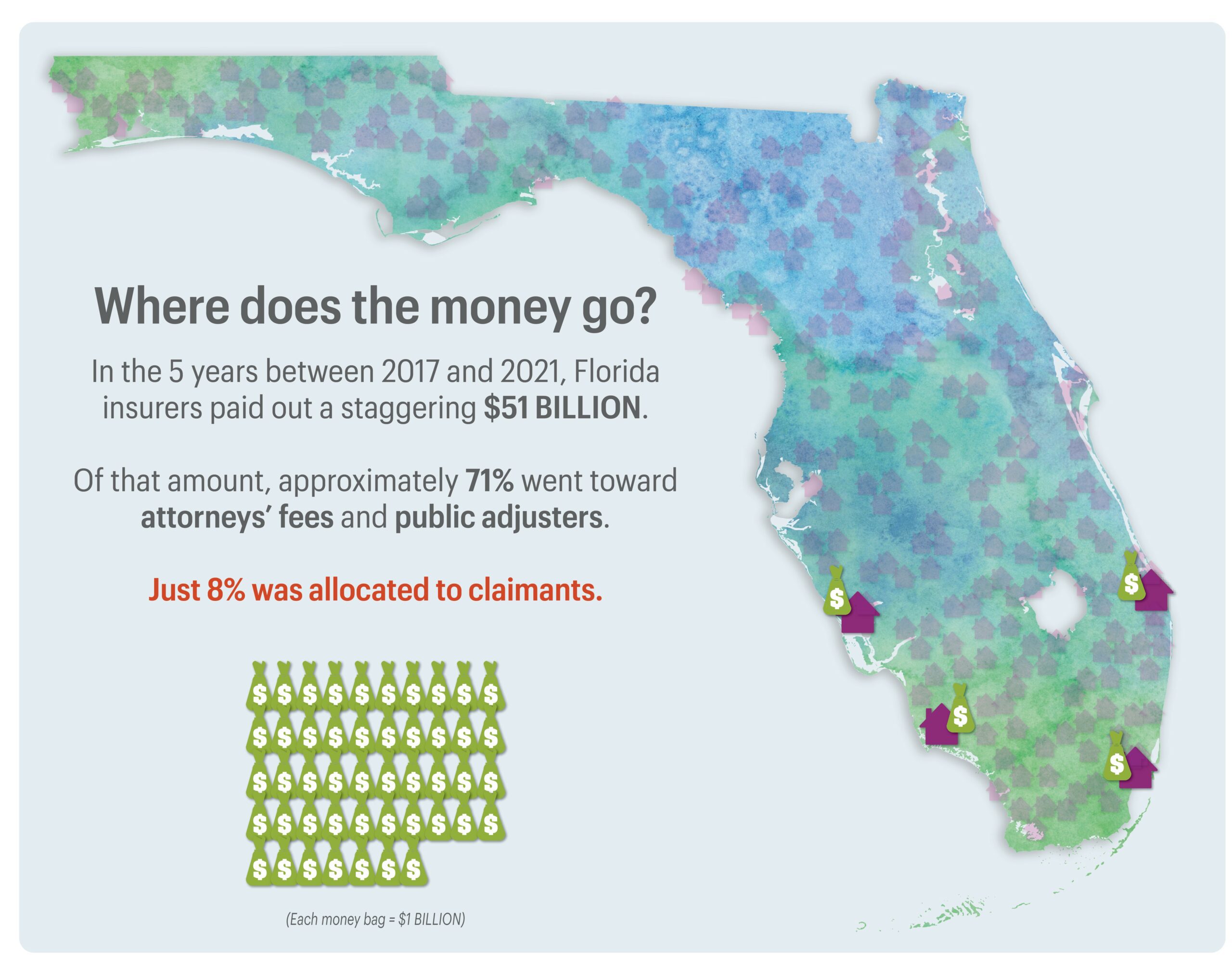

Between 2017 and 2021, Florida insurers paid out a staggering $51 billion with approximately 71% of that amount going toward attorney’s fees and public adjusters, while only 8% was allocated to claimants. This imbalance highlights the financial strain caused by excessive litigation and the need for reforms to address this issue.

Increasing Reinsurance Rates and Insurer Insolvency

The rising cost of reinsurance, which insurance companies purchase to protect themselves from catastrophic losses, has also played a significant role in the increasing premiums for homeowners insurance in Florida. The catastrophic hurricane season in 2022 resulted in estimated insured losses of $60 billion from Hurricane Ian alone. Florida carriers have seen their risk transfer pricing surge, with rate increases averaging between 30% and 50% for the year while non-Florida risks are up by 10% to 20%. As a consequence, at least a dozen insurance companies have stopped issuing new policies and three companies have announced their intentions of leaving the state, further driving up property insurance rates. Farmers Insurance announced in July 2023 that it is ending coverage in Florida, affecting approximately 100,000 current policies.

Insurer insolvency has become a pressing concern in Florida, with several private insurers facing financial difficulties. United Property and Casualty Insurance Co., for example, was one of the 10 homeowners’ insurance companies that went out of business in the last five years in the state. These insolvencies leave policyholders with uncertainties and contribute to the overall rise in insurance costs.

Government Response and Proposed Solutions

In response to the insurance crisis, Florida Governor Ron DeSantis signed a property insurance overhaul bill at the end of 2022. This bill, while offering tax rebates for those affected by recent hurricanes, did not directly address the rising costs of insurance. Instead, it required Citizens Property Insurance Corporation policyholders to switch to private insurance companies if their renewal offer was less than 20% higher. It also mandated flood insurance for first-time Citizens customers in flood zones, regardless of their dwelling type.

However, State Senator Tracie Davis has urged Governor DeSantis to convene another special session to address the skyrocketing insurance premiums and policy cancellations. Proposed reforms include measures to combat insurance fraud, excessive litigation, and the implementation of assistance programs such as the Florida Optional Reinsurance Assistance (FORA) program. These initiatives aim to provide relief for homeowners and ensure the stability of the insurance market.

Patrick Gleason, co-owner and managing partner of State Insurance Agency, shared, “Over the past 3 years several legislative initiatives have been passed in an effort to stabilize the marketplace and improve access to affordable property insurance in Florida. The most impactful parts of the legislation were focused on controlling the cost of litigation. A major component was eliminating the one-way attorney fee statute which historically prevented a level playing field, and drove a tsunami of frivolous and inflated claims resulting in increased premiums and fewer options. Although the changes made are expected to provide a positive result, it will take time.”

Finding Affordable Homeowners Insurance in Florida

Despite the challenges, homeowners in Florida can take certain steps to obtain more affordable insurance coverage. Here are a few tips to consider:

1. Shop Around for the Best Rates

Comparing quotes from multiple insurance companies can help homeowners find the best pricing and coverage options. By obtaining several quotes, individuals can ensure they are getting the most competitive rates available.

2. Bundle Insurance Policies

Purchasing both home and auto insurance from the same provider can often result in significant savings. Bundling policies not only simplifies bill payments but can also lead to discounted premiums.

3. Increase Deductibles

Opting for higher deductibles on homeowner’s insurance can lower premiums. However, homeowners should carefully weigh the potential savings against the increased out-of-pocket expenses in the event of a claim.

4. Explore Available Discounts

Homeowners should research potential discounts offered by insurance providers. These discounts can vary from loyalty discounts for long-term policyholders to claim-free discounts for those who haven’t filed claims within a specific period.

5. Even When You Have a Policy, Conduct a Periodic Review

Insurance agents possess proficiency in evaluating insurance coverage and enhancing its quality. However, not all conduct periodic assessments to ensure its competitiveness after you become a client. Insurance agents possess proficiency in evaluating insurance coverage and enhancing its quality. While we review our client’s coverage every year, not all agents or advisors conduct periodic assessments to ensure the policy’s competitiveness after you become a client. Make sure to create regular calendar reminders prompting you to review your coverage every year or two.

The rising costs of homeowners insurance in Florida pose significant challenges for residents. Factors such as severe weather events, insurance fraud, litigation, and insurer insolvency have all contributed to the surge in premiums. While government reforms and assistance programs aim to address these issues, homeowners can take proactive steps to find more affordable insurance coverage. By comparing rates, bundling policies, increasing deductibles, and exploring available discounts, individuals can mitigate the financial strain and protect their homes effectively. HBKS works with many Property and Casualty agents, please reach out if you need a referral.

Sources:

https://www.policygenius.com/homeowners-insurance/states-with-the-most-hurricanes/

https://www.aoml.noaa.gov/hrd/hurdat/All_U.S._Hurricanes.html

https://www.nbcmiami.com/news/local/watch-live-noaa-gives-update-on-its-outlook-for-the-2023-atlantic-hurricane-season-as-we-head-into-the-peak-period/3089114/

https://www.cnn.com/2023/06/01/business/florida-homeowner-insurance-rates/index.html

https://www.tallahassee.com/story/news/politics/2022/12/16/florida-homeowners-will-pay-more-ron-desantis-signs-property-insurance-package/69734504007/

https://www.pnj.com/story/money/2023/07/12/florida-insurance-crisis-farmers-insurance-home-insurance-what-to-know/70407302007/

https://www.reuters.com/business/insurers-stare-up-60-bln-hit-hurricane-ian-aig-chief-zaffino-says-2022-11-02/

https://www.washingtonpost.com/climate-environment/2023/07/12/farmers-insurance-leaves-florida/

https://www.washingtonpost.com/climate-environment/2023/07/12/farmers-insurance-leaves-florida/

https://www.tampabay.com/news/florida-politics/2023/08/23/property-homeowners-insurance-sawgrass-insolvent-patronis-regulators/

https://www.tampabay.com/news/florida-politics/2023/08/23/property-homeowners-insurance-sawgrass-insolvent-patronis-regulators/

IMPORTANT DISCLOSURES

The information included in this document is for general, informational purposes only. It does not contain any investment advice and does not address any individual facts and circumstances. As such, it cannot be relied on as providing any investment advice. If you would like investment advice regarding your specific facts and circumstances, please contact a qualified financial advisor.

Any investment involves some degree of risk, and different types of investments involve varying degrees of risk, including loss of principal. It should not be assumed that future performance of any specific investment, strategy or allocation (including those recommended by HBKS® Wealth Advisors) will be profitable or equal the corresponding indicated or intended results or performance level(s). Past performance of any security, indices, strategy or allocation may not be indicative of future results.

The historical and current information as to rules, laws, guidelines or benefits contained in this document is a summary of information obtained from or prepared by other sources. It has not been independently verified, but was obtained from sources believed to be reliable. HBKS® Wealth Advisors does not guarantee the accuracy of this information and does not assume liability for any errors in information obtained from or prepared by these other sources.

HBKS® Wealth Advisors is not a legal or accounting firm, and does not render legal, accounting or tax advice. You should contact an attorney or CPA if you wish to receive legal, accounting or tax advice.