Many of us haven’t seen rising interest rates and inflation for a long time; some of us, never. The combination injects fear into the market—and a lot of volatility. It also generates a million questions from investors. What to do? With rising rates, aren’t bonds a terrible idea? Should we put it all in cash, or move it into dividend stocks?

Let’s first address the idea of selling everything and putting it all in cash. Not a good idea—at least not beyond a reasonable cash reserve that we would have in flat, rising, or falling interest rate environments. Cash loses to inflation, last year by about 7 percent. Cash also eliminates market return potential. Bonds and other investments may decline in value at times, but they make money over time—and outdistance inflation. Cash can’t do that. In essence, cash is betting that you can see into the future, just like trying to time selling stocks and bonds. Historically that has turned out very poorly for investors.

Predicting the future

We can’t predict what is coming no matter how much we wish. As Neil Armstrong said, “Science has not yet mastered prophecy.” Or an older piece of wisdom: “Those who have knowledge don’t predict; those who predict, don’t have knowledge.” (Lao Tzu, 6th century BC)

So what will the next year bring? We can be so focused on rising rates that we might fail to consider that they may not rise. The Fed has said it will raise interest rates and the markets have priced in that expectation. But the Fed has also said it will be tactical and adjust as needed. What happens if the economy stumbles and enters a recession? What if it keeps interest rates at current levels? If you think the odds of that are zero, you might want to rethink that; if time has taught us anything, it’s to expect the unexpected. Consider 2020: when was the last time highly leveraged, unprofitable stocks were the saving grace of the stock market in a massive pullback? Never. When was the last time the so-called “dogs” were the high-quality balance sheets with strong cash flows? Never. Yet it was in 2020.

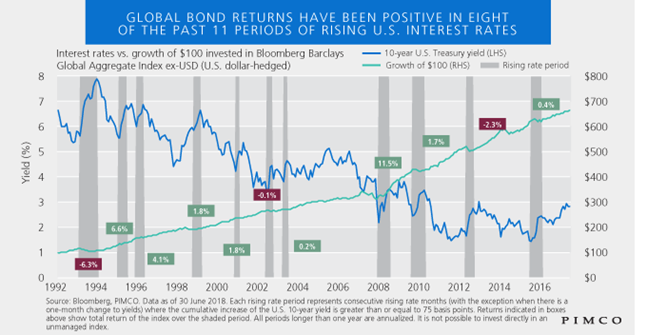

It is also important to point out that bonds have proven time and time again to be the best hedge against a large drop in stock prices. By only looking at the impact of rising rates on bond prices, you ignore multiple factors just as important in determining the performance of your portfolio and financial plan.

Bonds and risk

Questions arise around the risk of bonds during rising rates. Risk is relative. If stocks decline 20 percent and bonds decline 4 percent, which should concern you more? Are we focused on a risk of a small loss and ignoring stock risk? We need to keep our emotions in check and ensure that we are building a comprehensive portfolio with asset classes that fit your plan. We should be concerned with the risk of the entire portfolio, not just a piece of it—bonds, stocks, REITs, commodities, and other asset classes and investments.

But what should we do about bonds? We have spent a great deal of time and resources trying to answer that question and I have boiled it down to five core strategies I believe will serve you well in all rate environments. Sure some work better in certain environments, but when combined effectively, work to get you through stormy periods. All of them require a long-term focus, ignoring the short term, but should, over a five-to-ten-year span, allow you to stay invested, earn a reasonable return, deliver stability to your portfolio, and provide peace of mind to you. Note that some of these strategies are deployed as part of a fund or private manager, so if you are an HBKS client and don’t see something that says “duration strategy” in your portfolio, don’t be alarmed.

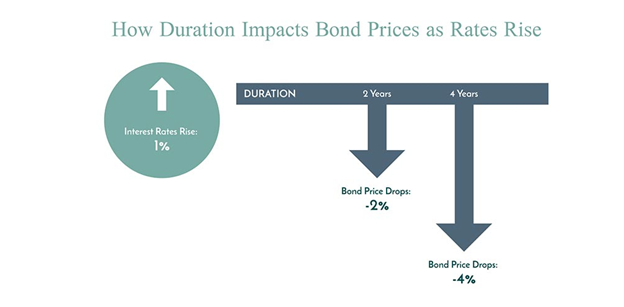

Manage Duration

The easiest way to manage the sensitivity of a portfolio to interest rates is to reduce the duration of the portfolio. As interest rates rise, the impact on the bond value is generally negative—that is, rising rates cause bonds to decline and vice versa. The impact of that temporary hit is measured as a “duration,” the expected sudden change in the value of a 1 percent move in rates. A duration of four means if rates rise 1 percent today the bond would fall by 4 percent that same day. Note it does not take into account that the bond will pay interest throughout the next year which will likely erode some of that loss. Duration is heavily impacted by bond maturity and also the structure of its interest payments. The measurement is also used in the average duration of a bond portfolio. As the below chart shows, the shorter the term, generally, the lower the duration and the less sensitive to interest rate changes. Like anything, shortening the duration has a cost. In this case the cost is lower yields than longer-term bonds.

For years we have expected rising rates, but haven’t seen them until recently. Sitting in short-term notes with short durations with the certainty of rising rates means you would have given up a pretty significant amount of yield over the last three-to-five years. The trick is to not have all your eggs in one strategy and also not to be too heavy long-term if you are expecting rising rates.

Source www.resourcereit.com

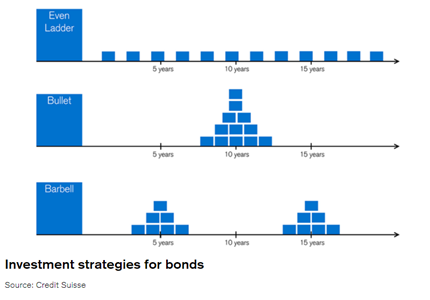

Barbells and Ladders

As long as you can stay disciplined to the strategy, “barbells and ladders” can be effective during rising rates. They will never be helpful in the short term with rising rates, but if ridden out over multi-year periods, the underperformance should be offset by two major factors: at maturity, the temporary devaluation of the bonds expires for the face value of the bond, and the higher long-term and future yields become the basis for both short-term and long-term yields over time. In other words, the low short-term rates are replaced with long-term rates over time and if those long-term rates are higher, you capitalize.

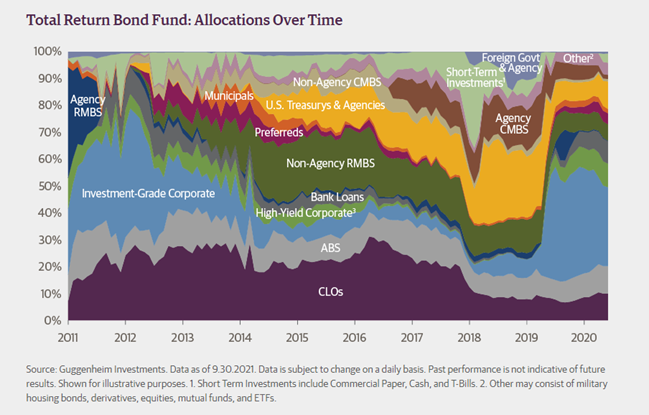

Tactical Managers

The current environment is not a time to own only bonds and ride them out. You want to have some tactical play in your portfolio. This might mean moving shorter or longer in duration. It could include moving up and down credit quality or perhaps re-mixing U.S. and foreign bonds. Being tactical gives you the best opportunity to use a manager’s best ideas and remain flexible in the process. Much like bond ladders and barbells, you need to give tactical managers time because some calls will be positive and others not, but a quality manager should do well over time.

Global Focus

Look around the world as not all places rise at the same time or rate. Also, yields vary from country to country. Diversification is a key driver in any good strategy and probably more so in this environment. It also can provide a currency diversifier if using unhedged or pure yield play if hedged.

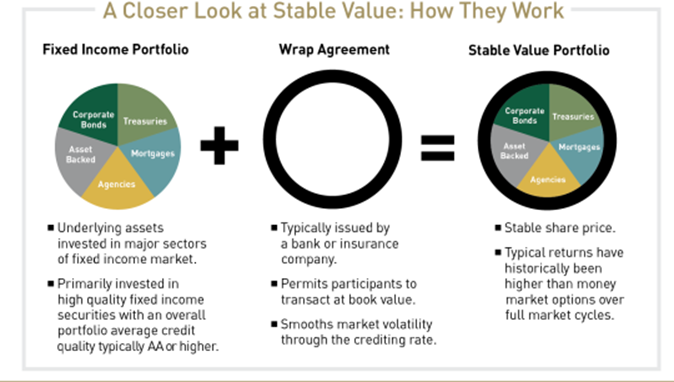

GICS and Annuities

Guaranteed Investment Contracts (GICs), otherwise known as Stable Value Funds, are exclusively offered in employer-sponsored retirement plans like 401(k)s. Generally, they are daily liquid insured pools, meaning they have no fluctuation, but do have a stated interest rate, which is declared quarterly. These pools are invested generally in a variety of longer-term bonds but provide stability and liquidity via insurance from a variety of providers like MetLife. Current rates range from 1.5 to 3 percent depending on the contract and plan. Most plans consider these a cash equivalent; however given the low volatility and reasonable yield, we are often parsing this into the bond allocation to help provide some stability. Not all people have access to GICs, and not all qualified plans offer these options.

Other less liquid options you could consider if you don’t have access to GICs include fixed and fixed-indexed annuities. While they have the potential for reasonable interest rate credits and low or no downside volatility, they generally come with a surrender penalty of five to ten years depending on the contract. Thus, they are not daily liquid, which can detract from their appeal. Annuities can have many other detractors from some of their advantages. That’s not to say they can’t be appropriate, but ask the advice of a knowledgeable financial professional before embarking on this strategy. In a perfect world, for a bond surrogate, we prefer to use GICS/Stable Value options as a complement to the bond portfolio vs the annuity route.

Source: Lord Abbett https://www.lordabbett.com/content/dam/lordabbett/en/documents/marketing-documents-manual-upload/whitepapers/Whitepaper_RET_Stable%20Value_053119.pdf

IMPORTANT DISCLOSURES

The information included in this document is for general, informational purposes only. It does not contain any investment advice and does not address any individual facts and circumstances. As such, it cannot be relied on as providing any investment advice. If you would like investment advice regarding your specific facts and circumstances, please contact a qualified financial advisor.

Any investment involves some degree of risk, and different types of investments involve varying degrees of risk, including loss of principal. It should not be assumed that future performance of any specific investment, strategy or allocation (including those recommended by HBKS® Wealth Advisors) will be profitable or equal to the corresponding indicated or intended results or performance level(s). Past performance of any security, indices, strategy or allocation may not be indicative of future results.

The historical and current information as to rules, laws, guidelines or benefits contained in this document is a summary of information obtained from or prepared by other sources. It has not been independently verified, but was obtained from sources believed to be reliable. HBKS® Wealth Advisors does not guarantee the accuracy of this information and does not assume liability for any errors in information obtained from or prepared by these other sources.

HBKS® Wealth Advisors is not a legal or accounting firm, and does not render legal, accounting or tax advice. You should contact an attorney or CPA if you wish to receive legal, accounting or tax advice.